As we emerge from the 2022 ‘finish line’ and leave behind pumpkin spiced lattes, wooly hats and festive celebrations, new perspectives are essential to remain one step ahead for 2023.

As the world continues to wade through the disruptions of the last two years, 2023-2024 will bring even more changes to the workplace – not least to the insurance industry. In fact, in their 2023 Global Insurance Industry Outlook report, Deloitte commented that our industry is at a crossroads to shaping long-term success. They also added that those organizations who “effectively transitioned during the pandemic to a remote workforce, as well as virtual customer and distributor engagement, could be better positioned to capitalize on a more agile digital infrastructure.” So, if your firm embraced remote working and all that came with it, you might already be one step ahead of the game.

Of course, there are two sides to every story. Although the pandemic fueled the digitization of our industry – from our working styles through to consultancy processes – the last two years also increased employee expectations. To ensure you’re prepared for what the future holds, let’s explore what the biggest L&D challenges facing the insurance industry in the next twelve months are.

A focus on long-term skills building

According to a recent PwC survey, 39% of insurance professionals think their job will be obsolete within five years. So, it’s no surprise that high-performing employees are focused on building long-term skills to future-proof their careers. But this long-term view isn’t typical behavior for insurance workers, and it certainly hasn’t been the focus of our organizational development. So, this shift in employee mindset and ambition means L&D has to do something different once and for all.

In 2023 and beyond, we need to become more intentional about upskilling. Instead of focusing development budgets solely on onboarding and compliance, it’s time to provide your people with the opportunity to develop broad skills that they might not have the opportunity to develop otherwise. Most of all, now is the time to move away from our traditional approach to career growth. Until recently, our employees have joined the firm, and worked their way up the metaphorical career ladder. They’ve stayed in incredibly similar fields, developing and harnessing a tight, specific group of skills to become a specialist. Today’s new hires are unlikely to follow that linear career growth – and it’s your job as an L&D professional to ensure they’re equipped for the squiggly career they may face.

Employees increasing expectations

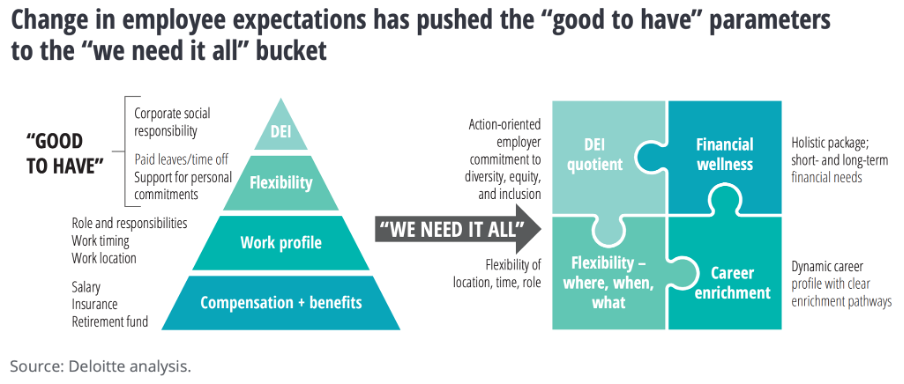

As a result of recent turbulent years, employee expectations in the global workplace have changed. Things that were a ‘nice to have’ in the past – such as flexible and remote working – are now on the top of the ‘must have’ list. And the insurance industry is not shielded from this change. In fact, a recent Deloitte analysis shows that ‘good to have’ has turned into ‘we need it all’ in our industry, as you can see in the image below.

So, what does this mean for L&D professionals in the insurance industry? Well to start, the demand for flexibility in location, time and role, means we need to accept that our long-loved face-to-face training will not be returning to the top spot any time soon. With increasing flexibility, our learning offering needs to be equally flexible. So, in our opinion, a blended approach to learning is the way to go.

Secondly, our employees are calling out for career enrichment and different pathways. They want diversity in their roles and careers, and of course, they’ll need the skills to go with it. If you want to retain top talent in your organization, it’s time to cater to these needs.

The need for communication skills is on the rise

We are all well-aware how tough the current economic, environmental and geo-political climate has been on the insurance industry – these issues remain the biggest challenges our organizations are facing both now, next year, and probably a few more years beyond that. Although you may think that L&D cannot do much to combat these issues, there is one way in which we can help our employees: improving their communication skills.

Recently, five of the largest publicly traded P&C insurers and reinsurers have admitted that supply chain disruption is on the up. Coupling this with the increase in the consumer price index (CPI) and other economic disruptions, insurance premiums are also increasing. Although tackling this head-first isn’t necessarily within the learning team’s remit, ensuring our employees can communicate these changes in a fair, clear and unbiased way is. With this in mind, is your communication training up to scratch?

2023: The perfect opportunity to refresh your training catalog

Of course, these are just three of the biggest L&D challenges facing the insurance industry, and there may be more on the horizon. In the last few years, we’ve learned that we cannot predict what will happen and change the route of our business. But one thing we can be sure of – our people will always need the right learning and development opportunities to help them tackle whatever comes our way. So, as we head into a new year and as we continue to recover from the pandemic and all the challenges it brought with it, is it time to refresh your training catalog?

If you would like to refresh your training catalog, why not check out our ready-start courses, all tailor-made for the insurance industry. Or get in touch, for the bespoke learning treatment.